By Steve Eubanks

By Steve Eubanks

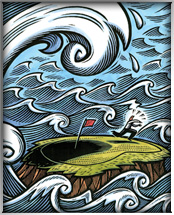

Despite many bleak predictions, some operators refuse to be washed away by the current economic tsunami

One of the saddest and spookiest images in recent history is a photo from 2004 that was taken from the upper floor of a beachfront hotel in Thailand. The shot showed hundreds of tourists, merchants, fishermen, women and children staring in curiosity as the waters of the Indian Ocean receded and the beach expanded. Moments after that picture was snapped, the largest and deadliest tsunami in history swept ashore with the strength of 23,000 Hiroshima-sized bombs, killing an estimated 300,000 people.

This tragic metaphor isn't lost on some course operators as they look to the year ahead. On the surface, the landscape appears peaceful, but many fear it's the calm before the proverbial storm. Or, perhaps more appropriately, the continuation of a disaster whose end seems nowhere in sight.

"I'm afraid 2010 is going to be very much reflective of what we saw in 2009," predicts M.G. Orender, president of Hampton Golf, a multi-facility operator headquartered in Jacksonville, Florida, and a past president of the PGA of America. "I don't see much of a bounce. In fact, I see more golf courses closing or being taken back by various institutions."

Orender isn't alone in his apocalyptic assessment of the immediate future. A recent report from the National Golf Foundation suggested that one golf course in the United States needed to close every five days for the next five years to bring supply in line with demand. The organization doesn't use that exact language and for good reason-the irony would be too rich. After all, it was the NGF which reported 20 years ago that America needed to open a new course every day between 1989 and 2000 in order to keep pace with the exploding demand for golf, a conclusion Forbes magazine later described as "extrapolation madness."

A potential uptick in course closures isn't the only dynamic casting a pall over the industry's outlook; rampant discounting, rising unemployment and fewer rounds played are all conspiring to create what might be considered the golf industry's version of the perfect storm.

"I talk to as many people in the industry as anyone, and I haven't talked to anybody who is only down 3 percent," says Orender, disputing industry claims that rounds played are off between 2.5 percent and 3 percent nationally. "Not only are rounds down by more than that, anyone who is down as little as 5 percent from last year in terms of rounds is down more than that in revenues because they're dropping the price. Operators are discounting and not getting more rounds from it. As a result, they're destroying their margins."

With rounds, revenue and margins sputtering at most facilities, operators have been (and, no doubt, will continue) looking to trim costs wherever possible. More often than not, these cost-cutting exercises are taking place on the maintenance front, as evidenced by a recent survey commissioned by the Golf Course Superintendent's Association. Findings show that 61 percent of all courses have cut employees, while 25 percent expect to reduce the number of workers even further in the next 12 months.

Capital expenditures have also fallen in proportion to tumbling yields or been placed on hold altogether. So, those cart paths that needed repaving last year aren't likely to get resurfacing this year, and the chipped tile in the locker room will just have to do for the foreseeable future.

Making matters worse, expenses are only expected to rise in the coming months, given the number of new taxes and health care legislation working its way through Congress. Of particular interest is an amendment to Senator Max Baucus' (D-Montana) health care reform bill, the America's Healthy Future Act, offered by Senators John Kerry (D-Massachusetts) and Jeff Bingaman (D-New Mexico). The Kerry-Bingaman amendment, which mirrors the employer mandate found in the pending House bill, would require employers to provide health insurance for all employees, both full and part-time. The current Senate bill does not explicitly compel employers to provide health insurance for their workers (called an employer mandate). Instead, employers with more than 50 employees would be able to choose not to offer insurance and would then be required to pay a fee if any of their employees receive their health insurance from the government-subsidized health care exchange.

"Not only does the [Kerry-Bingaman] amendment have a direct impact on clubs-because part-time club employees would have to be offered insurance-but this amendment also has an indirect impact on the industry," explains Brad Steele, vice president of government relations and general counsel for the National Club Association. "If a club's individual members run small businesses, then they'll be required to provide health insurance for their employees, whether or not they can afford it. This amendment will force them to pay an additional cost for their employees, meaning they'll most likely have less to spend at the club."

The other impending calamity that threatens to rock the golf industry to its core is access to capital. Between late 2008 and throughout 2009, such golf-centric lenders as Textron Financial, GE Capital and Capmark either exited the golf business altogether or greatly reduced their number of loans. Even those owners who are surviving, making payments and squeezing out a modest profit are finding it nearly impossible to secure debt, which inhibits their ability to invest in equipment, services and people.

What's more, the average golf course loan is five years, so when those notes come due-regardless of whether or not the assets have performed-operators will struggle to find a lender who can keep them going. "Who's financing golf right now?" Orender asks rhetorically. "Nobody. If you look at Textron, they have taken back 15 or 16 golf courses, and they have more coming back to them. They own E-Z-Go and Jacobsen, and it's hard to get them to finance their own equipment. What does that tell you?"

It tells you that things may get worse before they get better. "Market forces should rebalance supply and demand, but that's going to be tough," says Matt Galvin, executive vice president of RDC Golf Group, a New Jersey-based firm that manages courses in New York, New Jersey and Orlando, Florida. "Unlike a shopping center or a restaurant, which can be converted to some other use pretty quickly, a golf course is a little tougher to redeploy, especially in a down real estate market."

If there's one potential lifeline in this sea of despair, it's that banks-many of which have reluctantly (or, more precisely, unavoidably) been thrust into ownership roles due to loan defaults and foreclosures-really don't want to be in the golf business. "So, they're working with owners, doing things to at least kick the can down the road a little further," Galvin notes.

Despite such grim macro-economic news, some course operators are cautiously optimistic about prospects for 2010. They all agree the industry is contracting, yet many believe that by doubling down on their marketing efforts and appealing to the friends they've made in their communities, they can not only weather the storm but, in some cases, grow their business over the next 12 months.

"We're not naïve-we're concerned about the real estate market and inflation and the whole health care thing-but I'm not sure how much good it will do for us to sit and worry about it," says Allison George, general manager of Toad Valley Golf Course in Pleasant Hill, Iowa. "I believe attitude is everything and I tend to be an optimistic person, but we've also seen some good signs."

Last year, for instance, George noticed a growing number of area golfers chose to forego their out-of-town vacation in favor of that newest of fads-staycations-and her business benefited from it. Even so, she's not content to simply rest on her laurels and hope that 2010 produces similar results.

"Now, we have to be creative," says George, who recently used a family trip to Disney World as an opportunity to observe what marketers of the Mouse do to "make people want to come and spend money there." Imitation may equate to flattery for those being mimicked, but it's becoming a way of survival for those not too proud to do it.

"You have to look at everyone," George adds. "What are the successful people doing during down times to attract customers and keep them coming? Sometimes the stuff works, sometimes it doesn't. But you have to try different things all the time."

Trying different things, at least for operators like George, doesn't require an investment in new technology; rather, it's a foray into some programming and offerings that might otherwise be considered "non-traditional," at least by modern golf business standards. Take, for instance, the Friday afternoon couples league Toad Valley unveiled last year that featured nine holes of golf and babysitting services in the clubhouse to entice parents. Older kids spent their time watching movies, eating popcorn and playing putt-putt, while younger children enjoyed story time and other age-appropriate activities. When parents completed their rounds, the entire family gathered for an informal dinner.

A young mother herself, George is particularly keen to entice some of the other moms and dads she sees on the local soccer fields and basketball courts to Toad Valley. That's why she also introduced a "Super Family Rate" that allowed parents and kids to all play for a total of $25 after 6 p.m.

"I know a lot of people in the industry preach, 'Don't discount, don't discount,' but we didn't view this as a discount," George notes. "It was a time when people weren't playing anyway, and it was a way of competing against other family activities like baseball or skating or going to the movies."

Whatever you call it, you can't discount the results. Georges estimates revenues from the promotion-coupled with ancillary retail and food-and-beverage purchases-totaled $40,000 in 2009. With plans to once again offer the special in 2010, she hopes the income will be greater.

As much as anything, however, these new programs reflect the management of Toad Valley's belief that the golf industry, as a whole, is spending too much time and effort trying to attract the same customers: avid golfers.

"That's a shrinking market, so we completely changed our philosophy," George explains. "We go after the golfer that only plays four or five times a year, and we do everything we can to make that experience as enjoyable as possible because there are a lot more of those golfers than there are avid golfers."

Not surprisingly, other single-asset operators are making similar changes. Steve Sanders, owner/manager of Great River Road Golf Club in Nauvoo, Illinois, is a staunch advocate of "getting off your butt, getting out there and trying things," whether it's creating an intramural league at the local middle school or hosting more night-golf events. Recently, he partnered with a local computer store to offer free green fees for four to anyone who spent $500 or more at Christmas. (Note: As of press time, the exact participation numbers had not been determined.)

"I connected with another struggling local business, made a friend for life, and I'm going to collect cart fees in an otherwise dead time," says Sanders, noting that even though his course is located in a region which has a 20 percent unemployment rate, he's "excited about this year."

No doubt, that air of optimism drifts east to Syracuse, Indiana, where Bob Carlson and his wife, Lorena, own Maxwelton Golf Club. They, like George and Sanders, "don't spend a lot of time studying yield management graphs." Instead, they look for ways to continually engage their customers and build loyalty.

"There's no point-of-sale-system that has the answer," Carlson says. "The answer is to know your market and do the things necessary to bring more people out to your course."

Call it buckling down, getting back to basics or old-fashioned blocking and tackling, one thing is certain: There is no one idea that will rescue a failing national economy or save an industry in peril. However, those owners who, in the words of Sanders, "get out and do things" rather than lamenting the demise of the way things used to be will most likely be the ones left standing when the current economic tsunami recedes.

"We're Christians and Matthew 6 tells us not to worry, so that's what we do," George says. "We keep plugging along with the understanding that some years are going to be better than others."

With any luck, 2010 will prove to be one of the better ones.

Steve Eubanks is an Atlanta-based freelance writer and former golf course owner.